A dummies guide and history of SWIFT

Russia demands, and its ally Trump agrees - russia should be un-sanctioned from SWIFT payments. This thread offers questions and answers around russia and SWIFT.

👉 A potted history of SWIFT

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global network that enables secure, standardised communication between banks and other financial institutions. It facilitates the exchange of financial messages, such as payments, securities transactions, and trade finance, across borders.

SWIFT does not handle actual funds but transmits the instructions for transferring money between banks.

Founded in 1973: SWIFT was created in response to the need for a more efficient and secure system to handle international financial communications. Prior to SWIFT, financial institutions relied on telex and fax to communicate, which was slow, error-prone, and lacked security.

Early Growth: In the late 1970s and early 1980s, SWIFT quickly gained adoption among major banks globally due to its ability to reduce the risks associated with international money transfers and its standardised messaging system.

Expansion: Over time, SWIFT expanded its services beyond simple payment instructions to include a variety of financial services, including securities trading, foreign exchange, and trade finance, thus becoming integral to the global financial system.

Current Role: Today, SWIFT connects over 11,000 financial institutions in more than 200 countries and territories. It processes millions of messages daily, making it a cornerstone of the global financial infrastructure. However, it does not hold funds or directly participate in the transfer of money; it merely provides the secure messaging network.

In recent years, SWIFT has also been at the center of geopolitical tensions, particularly with Russia's exclusion from the system as part of sanctions imposed by the West due to Russia's actions in Ukraine. Despite challenges, SWIFT continues to be the dominant player in international financial messaging.

The impact to Russia on being banned from using SWIFT:

Being banned from using the SWIFT payment system has had significant economic and financial impacts on Russia, particularly after it was excluded from the network due to its invasion of Ukraine in 2022. Here are the key consequences for Russia:

1. Disruption to International Transactions

Limited access to global markets: SWIFT is the primary messaging network that facilitates cross-border payments between banks. Without access to SWIFT, Russian banks and businesses face major difficulties in making or receiving international payments. This has disrupted Russia's ability to engage in global trade, including importing goods, paying for services, and conducting financial transactions with foreign companies and governments.

Business isolation: Russian companies that rely on global supply chains and foreign investments face substantial hurdles in conducting transactions. This has led to delays, increased costs, and the need to find alternative, often less efficient, means of conducting cross-border payments.

2. Impact on Financial Institutions

Banking restrictions: Several major Russian banks were removed from SWIFT, making it harder for them to settle payments or facilitate financial activities with foreign institutions. This leads to a collapse in the ease of conducting international banking operations, severely limiting Russia's financial connectivity.

Increased financial uncertainty: Russian banks face greater difficulty in managing liquidity and participating in global financial markets. The isolation from SWIFT can result in higher borrowing costs, limited access to international loans, and more strained relationships with foreign investors.

3. Challenges for Trade and Energy Transactions

Energy sector difficulties: Russia, a major exporter of energy resources like oil and natural gas, relies on international trade for its energy exports. The inability to easily process payments for energy exports complicates transactions with foreign buyers. Some countries have had to find alternative ways to settle payments, such as using intermediaries or non-SWIFT systems, which could increase costs and slow down the process.

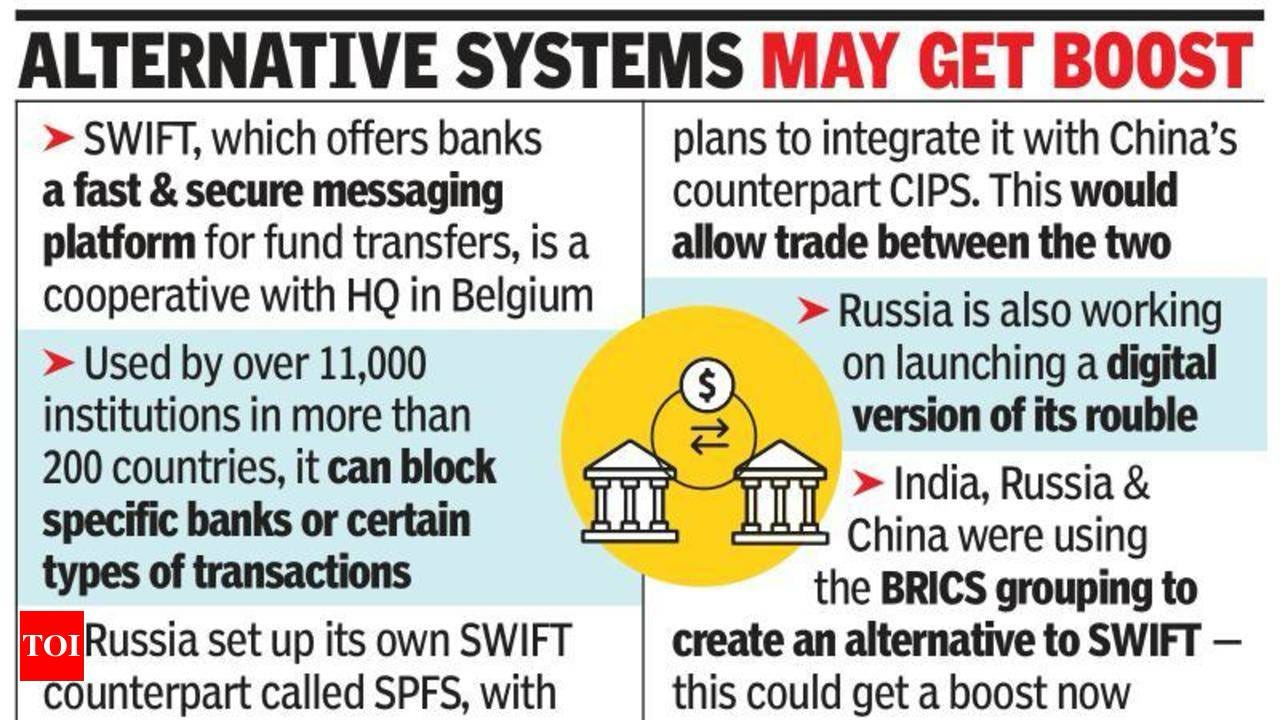

Increased reliance on alternative systems: Russia has sought alternative messaging systems, such as the Russian SPFS (System for Transfer of Financial Messages) and China's CIPS (Cross-Border Interbank Payment System), but these alternatives are not as widely accepted as SWIFT, limiting their effectiveness in global trade.

4. Economic Isolation and Sanctions

Worsening sanctions: Being cut off from SWIFT is one of the most significant financial sanctions that can be imposed on a country. It isolates Russia from the global financial system, reinforcing other sanctions and severely hampering its ability to access international markets and finance.

Reduced foreign investments: The inability to easily transfer funds or conduct business internationally has made Russia a less attractive destination for foreign investment, worsening its economic downturn.

5. Domestic Economic Effects

Currency volatility: The ban has led to increased volatility in the Russian ruble, as international investors and businesses have been reluctant to engage with the Russian economy, leading to exchange rate fluctuations.

Inflation and supply shortages: Due to disruptions in international trade and finance, Russia has faced supply shortages, rising costs for imports, and inflation in certain sectors, especially for goods that depend on international suppliers.

6. Political and Strategic Consequences

Diplomatic isolation: The exclusion from SWIFT is not just an economic blow but also a political statement, highlighting Russia's growing isolation from Western countries and international financial institutions.

Shift to alternative financial networks: Russia has been trying to reduce its dependency on Western financial systems by increasing its ties with countries like China and India, exploring alternatives to SWIFT, and strengthening its domestic financial infrastructure.

In summary, being banned from SWIFT has made it far more difficult for Russia to engage in global financial and trade activities, contributing to significant economic challenges. It has increased the country's isolation, limited its access to international finance, and made it harder to carry out everyday financial transactions with the rest of the world.

👉 Updates on the USA’s reported calls to have Russian banks un-sanctioned

As of March 30, 2025, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) has maintained its exclusion of certain Russian banks from its international payment messaging system. This action was initially taken in response to Russia's invasion of Ukraine in early 2022. The decision to exclude Russian banks from SWIFT was a coordinated effort among Western nations, aiming to isolate Russia financially.

U.S. Treasury Secretary Scott Bessent has recently indicated that the possibility of allowing Russian banks to rejoin SWIFT is under consideration, contingent upon progress in negotiations to end the conflict in Ukraine. However, he emphasised that any such decision would require consensus from European Union (EU) central banks, which play a crucial role in administering the SWIFT system. Bessent stated, "I think everything is on the table," but cautioned that discussing the terms of reinstating Russian banks to SWIFT is premature before achieving a broader agreement.

The authority to lift sanctions, including those affecting SWIFT access, lies primarily with the governments and international bodies that imposed them. In the EU, decisions require unanimity among member states. German Chancellor Olaf Scholz has expressed reservations about removing Russia from SWIFT, suggesting that such a measure should be reserved for situations where it becomes absolutely necessary. He noted that excluding Russia from SWIFT could have significant repercussions for European economies, given their dependence on Russian energy exports.

Calls for lifting sanctions, including reinstating Russian banks' access to SWIFT, have emerged from various quarters. Russia has demanded the removal of sanctions as a precondition for agreements such as the Black Sea security deal, specifically requesting the reconnection of its agricultural export bank to SWIFT.

Additionally, U.S. Treasury Secretary Bessent's recent comments suggest a potential openness to revisiting SWIFT-related sanctions, contingent upon progress in diplomatic negotiations.

However, European leaders, including those in Germany, have expressed caution, emphasising the need for a unified and cautious approach to any changes in sanctions policy.

👉 Russia wants to have access to SWIFT as a condition of any ceasefire.

As part of ceasefire proposals related to the ongoing conflict in Ukraine, Russia has called for the lifting of some international sanctions, including its exclusion from the SWIFT payment system. Russia has requested that specific sanctions be removed as a precondition for advancing agreements, such as those regarding security and trade. One of the key demands has been the reconnection of certain Russian banks to SWIFT, particularly those involved in agricultural exports, which are crucial to Russia's economy.

This demand has been tied to negotiations, especially those concerning the export of Russian grain and other agricultural products. For example, Russia has pushed for the reconnection of its agricultural export bank to SWIFT as part of deals like the Black Sea grain initiative, which was designed to facilitate the export of Ukrainian and Russian grain amidst the ongoing conflict.

While Russia’s calls to rejoin SWIFT have been part of broader diplomatic discussions, Western countries, particularly in the European Union and the U.S., remain cautious. The lifting of such sanctions, including the SWIFT ban, would require significant political negotiation, and any move in this direction would likely depend on the broader outcome of peace talks and the situation on the ground in Ukraine. Western leaders have emphasised that the lifting of sanctions, including those related to SWIFT, would only be considered if there is substantial progress in the conflict, including a lasting ceasefire and steps toward peace.

👉 Can Trump force SWIFT to lift sanctions on Russia?

Donald Trump cannot unilaterally force SWIFT to lift sanctions on Russia. SWIFT is a cooperative organisation owned by member financial institutions, and decisions regarding its operations, including sanctions, are made collectively by its members and in accordance with international agreements.

While the U.S. president has influence over U.S. foreign policy and can push for sanctions or policy changes, lifting sanctions on Russia, particularly those related to SWIFT, would require consensus from the European Union and other nations involved in imposing these measures.

Additionally, any decision to reintroduce Russia to SWIFT would be highly dependent on broader diplomatic negotiations and agreements on issues like the ongoing conflict in Ukraine, rather than the actions of any single leader.

👉 SWIFT and it’s strong link to the US Dollar.

Having explained that Trump could not unilaterally force SWIFT to allow russia back into the payments system, it is important to note that SWIFT has a very strong link to the US Dollar, and this could have a compelling effect on SWIFT doing what Trump wants.

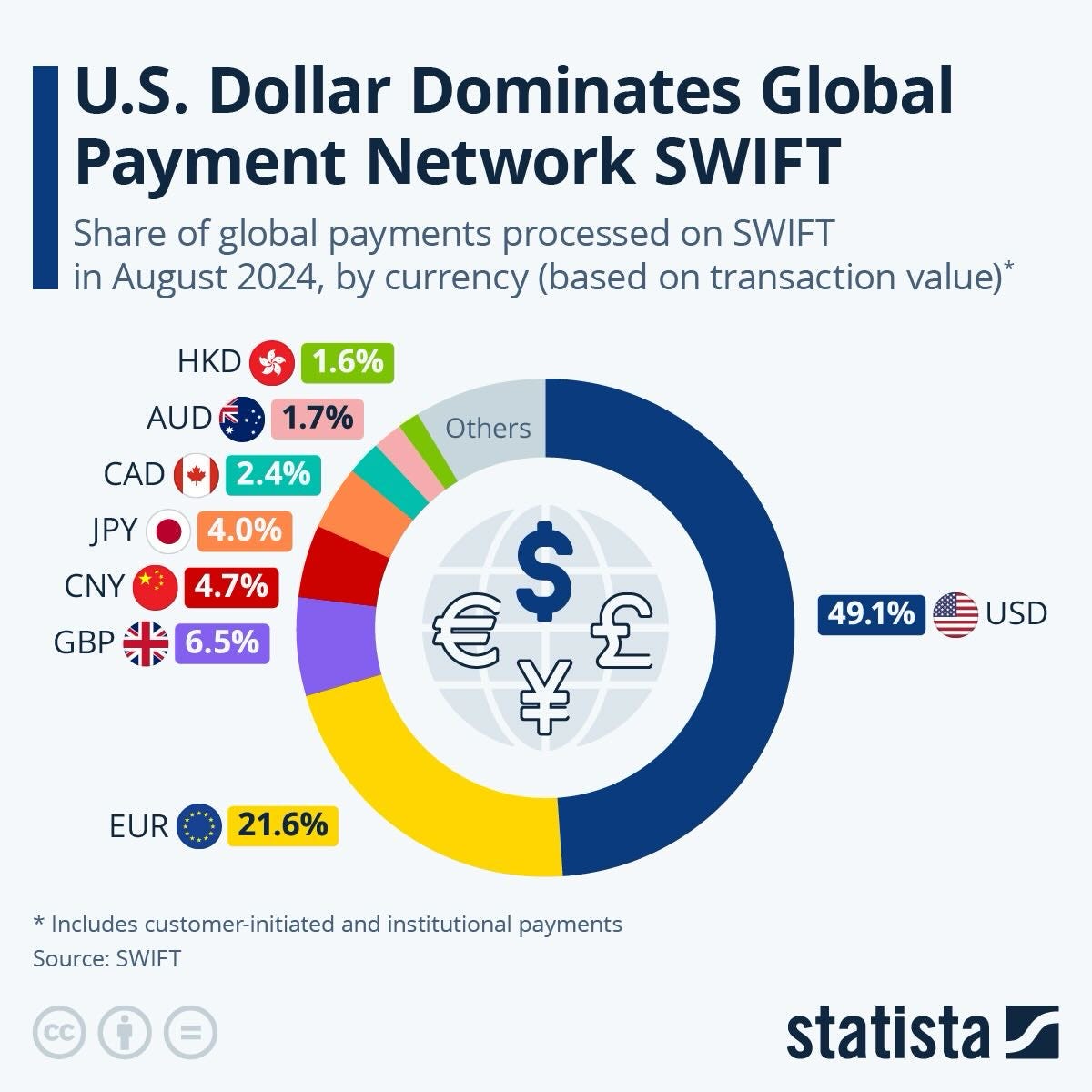

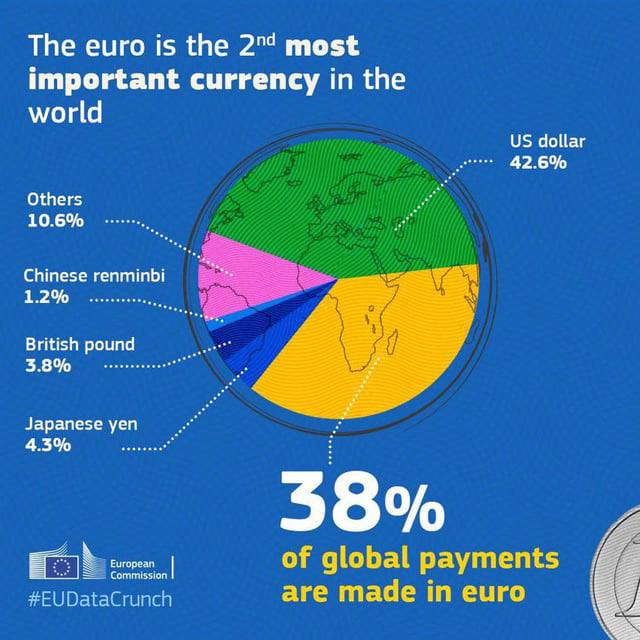

The majority of payments on SWIFT is made in U.S. dollars, with no other currency coming close to the dollar’s role in international payments. In August 2024, the dollar accounted for 49.1 percent of payments handled by SWIFT, followed by 21.6 percent for the euro, 6.5 percent for the British pound and 4.7 percent for the Chinese yuan.

But.. The Euro is an important player too!

March 28, 2025 - Moscow was quick to spell out its list of demands for a ceasefire. In its own read-out, the Kremlin added five paragraphs of conditions to be met before the so-called "Black Sea Initiative" is restored. The conditions call for lifting "sanctions" and "restrictions" that Russia says are constraining its exports of food products and fertilisers worldwide, including on agricultural machinery and insurance for cargoes.

The most notable demand is for the Russian Agricultural Bank, also known as Rosselkhozbank, and "other financial organisations" involved in the agricultural trade to be reconnected to SWIFT, a high-security system for rapid money transfers.

This is where the EU comes into play: SWIFT is a cooperative headquartered in La Hulpe, Belgium, and therefore subject to EU law and, crucially, EU sanctions.

Excluding payments within the Eurozone, the dollar’s share even climbs to 60 percent, illustrating its role as the closest thing we have to a “world currency”, much to the chagrin of Russia and other antagonists to the United States.

When leaders of the newly expanded BRICS group met in October 2024- in Kazan, Russia, one of the talking points was around Russia’s push for an alternative international payment platform that would reduce the U.S. dollar’s dominance in global trade and international payments and better shield countries like Russia from sanctions in the future.

References and sources:

https://www.politico.eu/article/commission-proposes-new-financial-sanctions-on-russia

https://www.thetimes.co.uk/article/ceasefire-talks-saudi-arabia-us-7vjghl363?utm

https://www.statista.com/chart/26943/currency-composition-of-payments-processed-on-swift/

http://www.kremlin.ru/events/president/news/76526

If you enjoy my threads, please consider supporting my work on Patreon or BuymeACoffee!

Thank You! to those who have supported me on Patreon or buymeacoffee, Thank You for keeping me going!.

buymeacoffee.com/beefeaterfella

patreon.com/Beefeater_Fella

beefeaterresearch.substack.com

BeefeaterFella youtube.com/@beefeaterfella

Thanks Beefy for an illuminating and insightful read, thoroughly absorbing from start to finish. It's reassuring to know that trump can't unilaterally readmit russia to the SWIFT banking system. The US's pro russian stance is sickening and putin is exploiting this to the hilt. John Bolton, Attorney and former US Ambassador to the UN has publicly stated that putin is playing trump and no one within his administration can see this